Less efficient machines

One of the most widely recognized benchmarks in chip fabrication is 7 nanometers. Although ostensibly a reference to the size of the process node, it is industry shorthand for cutting-edge technology for producing the high-performance chips that power smartphones and data centers.

The A12 at the heart of Apple’s iPhone XS and the Dojo D1 that powers Tesla’s semi-autonomous driving were both produced using TSMC’s 7 nm process.

SMIC offered two versions of the 7 nm process, the N+1 and the upgraded N+2. According to multiple people familiar with the situation, the Kirin 9000S chip is produced at N+2.

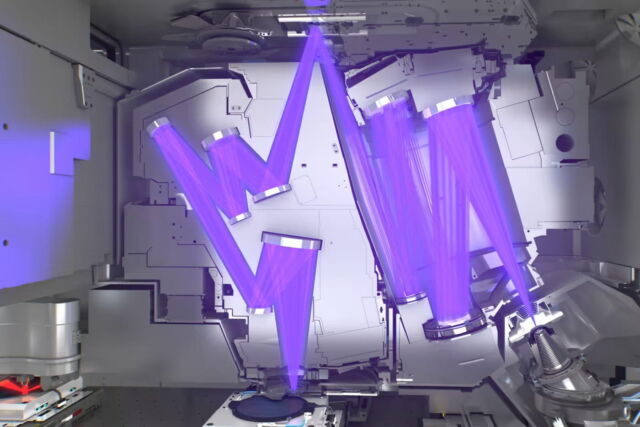

But while the likes of TSMC and Samsung used extreme ultraviolet (EUV) lithography equipment to build these chips, SMIC used the less efficient deep ultraviolet (DUV) machines, say industry experts and analysts.

“At first, it was because of budget limits,” says a semiconductor expert familiar with SMIC technology development path. “EUV is very expensive, and SMIC’s advanced process is generations behind TSMC, which left it without many customers and revenue.”

Lithography, whereby electric circuits are carved into silicon wafers, is fundamental to chip manufacture. More advanced lithography machines offer higher resolution, meaning thinner lines and more detail, allowing chips to be smaller.

Both machines can achieve 7 nm processes, but EUV is more efficient and precise, resulting in less waste.

SMIC used DUV machines to repeat the chipmaking steps that others did with EUV units, in order to boost transistor density. But this had a deleterious effect on the yield rate, which measures the proportion of working versus defective chips on each wafer.

According to ASML, the Dutch lithography machine manufacturer, it takes 34 lithography steps to achieve 7 nm on DUV machinery, compared to just nine steps with EUV. The additional production steps result in higher production costs and lower yields.

With each additional step, more chips would be thrown away, and equipment costs go up, says Brady Wang, a semiconductor analyst at Counterpoint. More components and materials are also consumed. But what began as a budgetary expedient became a necessity after EUV equipment that SMIC had ordered from ASML in 2019 was blocked, according to three people familiar with the situation.

The advanced lithography machine is subject to the Wassenaar Arrangement, a multilateral export control agreement formed by more than 40 nations to restrict the sale of products that could have a dual military purpose.

SMIC managed to scrape together equipment from existing plants and those received before Washington’s sanctions to keep the 7 nm production line going, say two sources close to SMIC’s suppliers.

But this still left it without the additional support that ASML typically provides for customers of the highly complex machines. “The condition is harsh,” says one chip company executive close to SMIC. “Basically, no software updates and no equipment factory engineers to carry out maintenance services.”

US officials were surprised SMIC was able to acquire the spare parts and technical services needed to keep its 7 nm production facility operational even after the export controls, says Allen.

Industry insiders close to SMIC acknowledge it is possible some equipment was obtained in violation of export controls. US semiconductor equipment manufacturer Applied Materials is already being investigated for potential violations of export restrictions, according to Reuters.

Applied Materials said in a statement to newswires that it “is co-operating with the government and remains committed to compliance and global laws, including export controls and trade regulations.” AMAT did not respond to a request for comment.

reader comments

197